Could Sebi’s ban on investment advisers disrupt financial planning in India?

The move has sparked widespread concern among advisers, who fear it could signal the end of comprehensive financial planning and undermine the comprehensiveness of their services.

Challenge

Many people looking for financial guidance turn to a financial advisor for a comprehensive plan that covers everything from mutual funds to taxes and estate planning. Now, this whole process is under threat with Sebi proposing to curtail these services under investment adviser (IA) licence.

If consultants wished to continue to provide such services, they would need to do so through separate legal entities and under different names.

Regulation overhaul

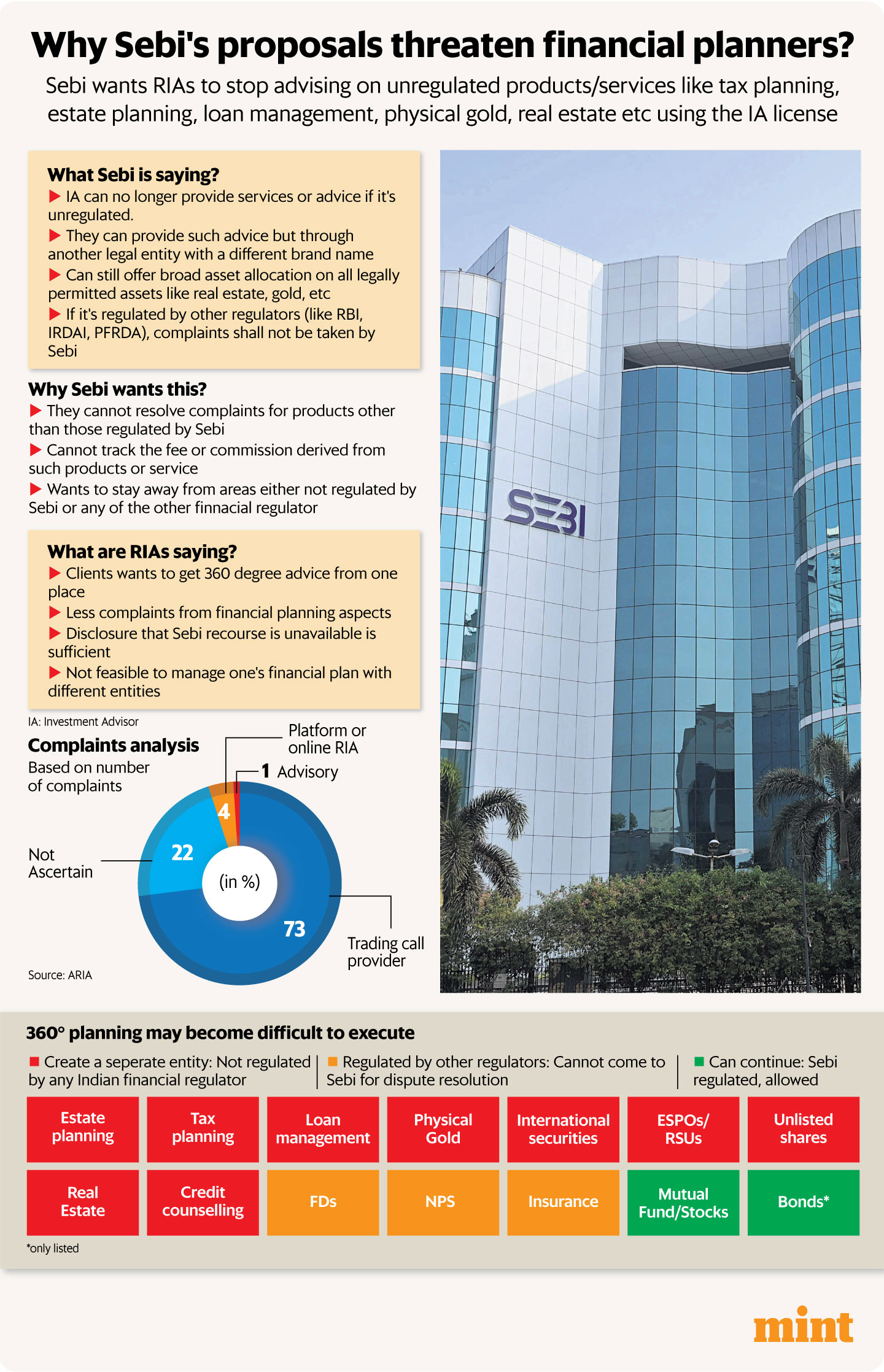

In a discussion paper, Sebi proposed that financial advisors no longer offer services such as tax planning, estate planning, debt management, real estate, gold, or bitcoin under their IA license. Sebi’s opinion: these products are not regulated or fall outside its jurisdiction, making it difficult to deal with customer complaints related to such offerings.

However, for services or products regulated by other authorities, financial advisors may continue to work, as long as complaints are handled by the relevant authority.

Also read | How Sebi’s reforms could change India’s investment advisory landscape

For example, complaints related to fixed deposits are handled by the Reserve Bank of India, those related to the National Pension Scheme by the Pension Fund Regulatory and Development Authority, and complaints related to insurance by the Insurance Regulatory and Development Authority.

While Sebi intends to divest itself from unregulated and regulated products, RIAs can continue to provide general asset allocation advice, such as advising clients to allocate a portion of the funds to see the different groups of goods.

However, Sebi does not require them to actively manage these assets or engage in tax planning under an IA licence.

View Full Image

The counselor steps back

When the IA regulations were introduced in 2013, Sebi included “financial planning” as part of investment advice.

Now, Sebi intends to remove “financial planning” from the license level which mandates advisers to focus only on the management of regulated assets.

“We provide what our clients want and expect from us to provide 360-degree financial planning,” said Renu Maheshwari, registered investment advisor and vice chair of the Association of Registered Investment Advisors (ARIA), he said.

If an investment advisor only focuses on certain products without considering the whole financial picture, it’s like selling a product, he said. “Investment advice is part of financial planning and Sebi looks at it differently.”

A financial planner usually looks at a client’s income, debt, home equity, tax liability, and other factors to find the right investment.

Maheshwari added: “If I don’t advise on insurance products or risk management, while doing investment advice, I will miss out on other risks that the client is taking,” to added Maheshwari. we are looking at customer solutions.”

The book’s definition of financial planning includes various aspects of one’s financial life, such as education funds, insurance, taxes and estate planning. In addition, many investment advisors provide advice on international stocks or on employee stock options in global companies.

However, Sebi’s consultation paper proposes that such assets be excluded from the scope of investment advisers, as they may not be regulated or monitored by foreign regulators.

Suresh Sadagopan, investment advisor and founder of Ladder7 Financial Advisories, argued that creating a financial plan for someone using separate entities would be too difficult. “It will be difficult and impossible to create many organizations to satisfy the needs of one customer.”

Harsh Roongta, RIA and founder of Fee-Only Investment Advisors, said that Sebi’s concerns about complaints related to products that are not regulated and overseen by other agencies are not justified.

Also read | How Sebi cracks down on unregistered investment advisers

According to data compiled by the Association of Registered Investment Advisors (ARIA), 73% of the complaints received by Sebi since the introduction of the RIA regulations were about commercial telephone providers, and 1 Only % related to consulting services. (see infographic)

“I believe that futures and options (F&O) advice should not be allowed under the RIA license because that is where most of the complaints come from,” added Roongta.

In addition, complaints about products that are not regulated or monitored by the market authorities are not followed up separately.

Finding balance

Several registered investment advisers suggested that it might be better to provide clear disclosures to consumers that Sebi will not provide assistance for unregulated products, rather than requiring that separate organizations be created to provide advice on different products or services.

Roongta said that in developed markets like the US, despite the tough regulatory environment, there was no such tough demand for investors.

He also noted that Sebi allows temporary consultants to provide unregulated services on the plea that these activities fall outside the Sebi regulations.

Interestingly, Sebi has proposed to allow part-time advisers, including those with no financial education, to assist up to 75 clients as part of the same discussion paper.

Roongta suggested that full-time RIAs offering financial planning should also get the same treatment and Sebi should consider it.

“The customer comes to one person for complete financial advice. If it is split into two separate pieces, the offering will be broken,” Roongta added.

Another possible solution is for Sebi to list certain services, such as tax planning, wills and estate planning, while listing risky products within the financial framework.

Sebi has also gathered feedback from RIAs and is expected to consider its proposals before finalizing the regulations.

Consultants expect that the market regulator will solve their problems and that the new rules will adopt a comprehensive financial framework.

#Sebis #ban #investment #advisers #disrupt #financial #planning #India