Fears of a US recession are overblown

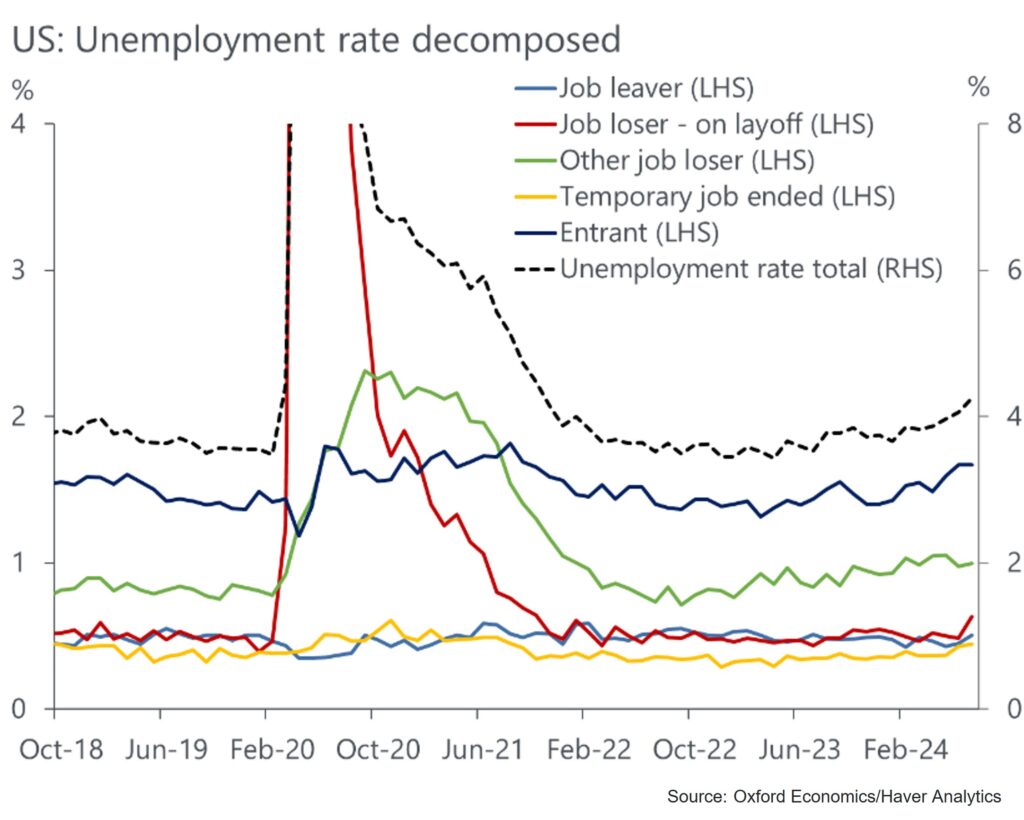

Sahm’s law historically indicates that an economy is in recession when the unemployment rate, over three months, rises 0.5ppts above the low of the previous 12 months. In the July activity report, it was launched for the first time in this cycle. A good rule of thumb is that a sustained 0.5ppt increase in the unemployment rate lowers the level of real consumer spending by 0.3% over the next two quarters. However, this law may be overpowered this time around as the cause of the increase in the unemployment rate is not that alarming.

Unlock exclusive economic and business information – sign up for our newsletter today

The unemployment rate increased significantly due to an increase in the labor supply and an increase in temporary layoffs, especially in July. This is no less alarming than when it is increasing because of people who have lost their jobs permanently – the link between high unemployment rates and economic recession.

There are no important statistics to measure the health of the economy and the unemployment rate has its limitations. We put a lot of money into the number of people in the first years of the population. The ratio of prime-time workers to population, which doesn’t get much attention in the financial markets, has been rising sharply since 2001 and is consistent with a strong labor market.

Historically the youth population ratio has had a strong correlation with the unemployment rate. This year this relationship is showing signs of slowing down, as the youth employment-to-population ratio and the unemployment rate continue to rise. This is another evidence that the rise in unemployment is a supply side thing but the markets, and their expectations for the outcome of the meeting in September depend on the unemployment rate.

How the Fed grinds

Historically, the Federal Open Market Committee has issued rate cuts of more than 25bps when there was severe economic stress or when the data was worse than it is now. The focus of our forecast is that job growth will recover in August and the FOMC will judge a 25bp rate cut as an adequate response to any downside risks. If we are wrong and the August jobs report is as weak as the July report, a 50bp cut in September is likely.

Financial markets have dramatically increased the likelihood of a 50bps rate cut in September and led to talk of central bank action. Both are overextended and knee-jerk. The reduction of the Federal Reserve is a history when the economy experiences great economic stress, and the July employment report does not meet those standards, although it is accompanied by a sudden drop in equity prices because corrections are common.

The Fed knows why the unemployment rate has increased and these sources are less threatening than if they were motivated by the rise of permanent jobs. The Fed will pay attention to early claims, as the August jobs report will be very important. If the unemployment rate does not change the latest interest rates and the structure is more related, the Fed will consider a 50bp rate cut at its September meeting.

Currently, we are holding our view from early April that the first rate cut will be in September to a 25bp cut.

Download the full report for in-depth details

The analyzes and forecasts in this blog are supported by our Global Macro Service, which measures the effects of economic and market developments in more than 200 economies. To unlock the power of economic insight, request a free trial by clicking here.

#Fears #recession #overblown