Decline in Yields Predicted (Again)

There is strong and growing evidence that the “next” US recession has started – or will start soon. It is true that many economists will remain uncertain about it, either because they have never predicted it, or because they refuse to predict it, or because they do not believe that something is true until it passes them by (maybe even then). Similarly tardy will be the National Bureau of Economic Research, but by design, because it gives “official” dates for the start and end of each recession and wants to be certain of the final version of the data that is regularly updated before making public announcements. Such “backcasting” and even “nowcasting” (provided by the New York Fed) is of little help to those who like it. foresight and time to fix before the problems started.

About a year ago, I reminded AIER readers that the US Treasury yield curve had inverted (ie, the 10-year bond yield was below the monthly interest rate 3), that all eight US recessions since 1968 have occurred first (12-18). months) with such a change (without negative signs of a recession without the first change), and that another recession could start in 2024. I wrote:

There has been no better, more reliable predictor of the US business cycle in recent decades than the initial structure of US Treasuries, and as of last October it has been indicate another recession may begin in 2024. This is important, because the recession. they have been associated with bear markets in stocks and bull markets in bonds. Furthermore, if the recession hits before 2024 it could affect the US election in November.

The fact that the stock yield signal works very well for recessions is one thing, but why does it work that well? In September 2019, when I was predicting the 2020 recession (which was deep but not due to the “Lockdowns” of COVID-19), I detailed these facts to AIER readers:

First, a sharp drop in bond yields means a sharp rise in bond prices, which suggests a greater demand for safe havens, reflecting investors’ desire for to inoculate against future problems. Second, the longer the maturity at which one borrows, the greater (usually) the yield one receives (due to credit risk and/or inflation risk), so if bond yields are below interest rate, indicates lower short-term yields. the future (ie, the Fed’s rate cut), which occurs during recessions. Third, the meaning of financial intermediation is organizations that “borrow short-term (short-term) and borrow long-term (long-term).” If long term products are up short-term yield, as usual, has a positive interest rate, which means that lending-investment is profitable. If, on the other hand, long-term yields are lower than short-term yields, there is a negative interest rate and the lending investment becomes unprofitable or is made (if it is so) at a loss. When market analysts see the credit markets “win” before (and during) a downturn, it reflects this very important role of financial intermediation.

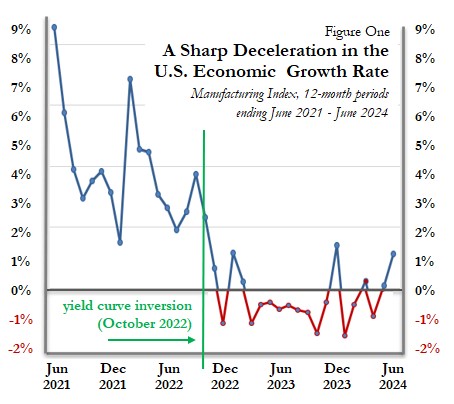

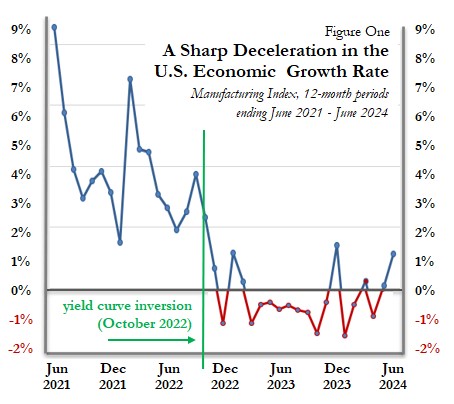

The most recent decline in the growth rate of US manufacturing output is shown in Figure 1, where I also show the point at which the most recent change in output began: October 2022. It was twenty-one months ago, while since 1968 there has been a recession. started about ten months (on average) after the first change. If the next recession starts soon, it will come after a longer period than usual, to be sure, but the period before the “Great Recession” in 2007-09 was also long. : 17 months. That it has been changed for a long time, it seems to have no bad results, can be interpreted as something bad. But the consequences are bad have has been registered: productivity growth has dropped to zero (Figure One).

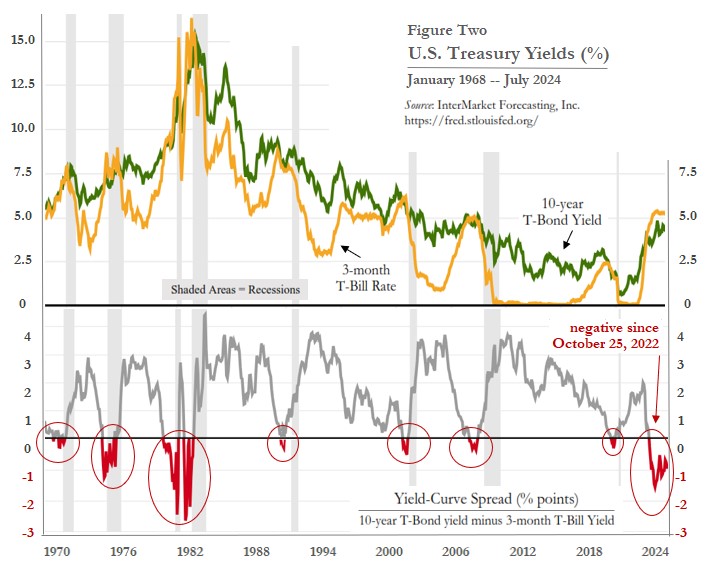

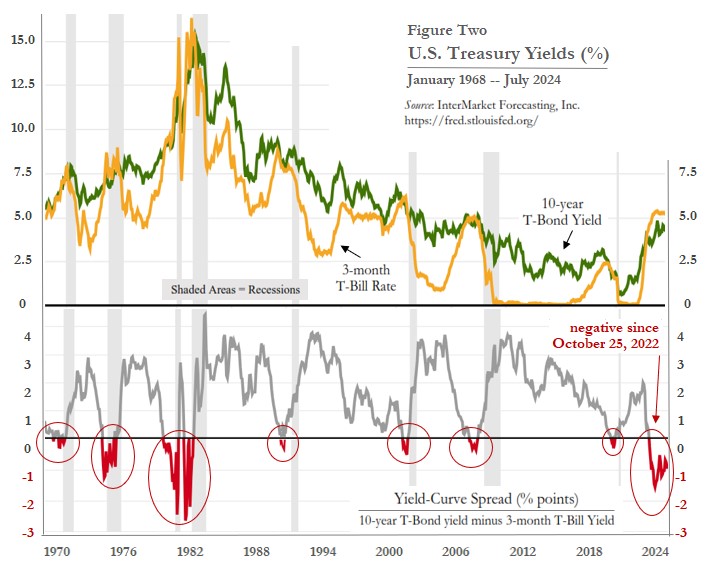

A detailed history of US Treasury bond and bond yields, yield rates, and the eight recessions recorded since 1968, is provided in Figure Two. In the lower panel, negative yield spreads (in red) include yield curve deviations (bond yields less than bond yields), which precede the reduction (blue shaded period). The above panel shows that the yield increases are often caused by the Fed’s rate hikes, which are said to “fight inflation,” but in fact fight, prevent and, if necessary, restore economic growth (which falsely thinks it causes inflation). The curve can also be reversed if the Fed keeps the short-term rate steady while bond yields fall.

Figure 2 shows that the recent downturn has been longer and deeper (worse) compared to previous recessions other than the early 1980s. Historically, the longer and deeper the first revolution, the longer and deeper the recession that followed. Sadly, this latest change is almost “off the charts.” Moreover, it is likely to continue for this year’s rate, as the Fed slows (or slows down) rate cuts. Therefore, the recession could be prolonged, lasting until 2025, possibly even 2026. The Great Recession lasted nineteen months; the same period from here brings us to March 2026. An unusually wide flow (deep in the wrong area) also suggests that the size of the future production contract may be larger than usual.

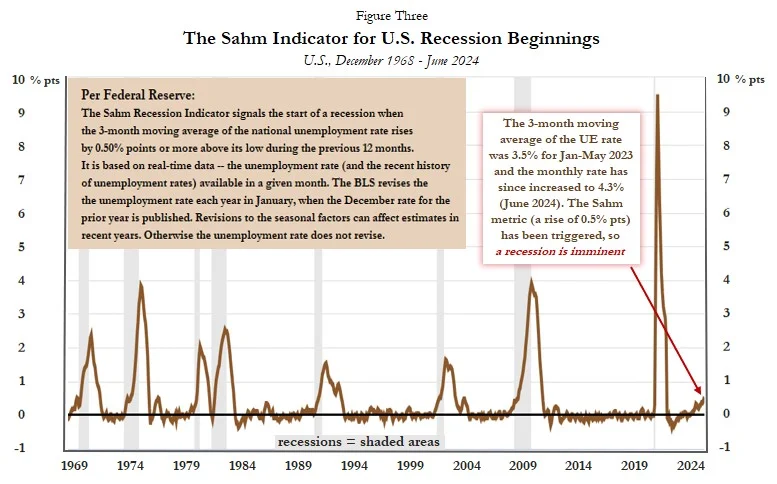

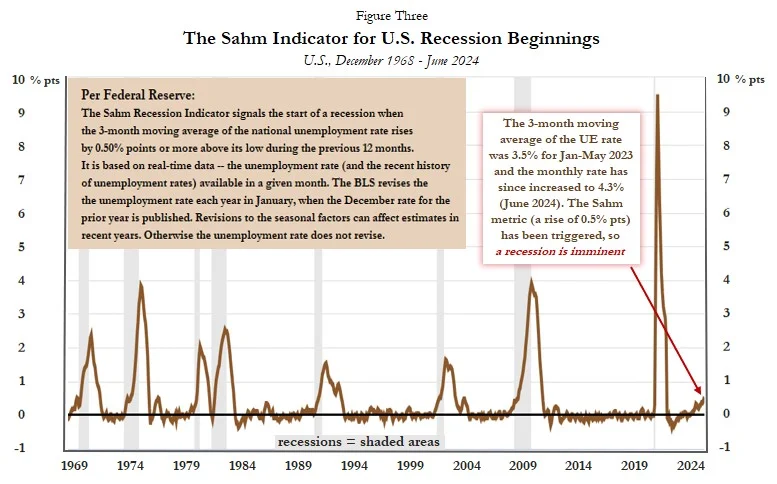

Although the yield curve provides the first and most reliable signal of an economic downturn – with enough time left for people to be vaccinated and change their spending habits, the plans of trading and investment portfolios – a short-term indicator is available (and reliable). It’s Sahm’s Law, based on the discovery (by Claudia Sahm) that recessions begin soon after a sharp rise in the unemployment rate. It doesn’t take much – the unemployment rate is at least 0.5 percentage points above the previous low.

Figure Three plots the level of the Sahm indicator since 1968. The most recently reported US unemployment rate was 4.3 percent (for June), which is 0.8 percentage points above the rate the first low (from early 2023) of 3.5 percent. Sahm’s limit has been crossed. This indicator works because once the unemployment rate rises at such a rate for a short period of time, it rarely changes. If a recession ends, the number of people out of work continues to rise until after the recovery.

Surprisingly, the yield signal alone did not convince many market experts of the impending economic crisis. So they are surprised by serious economic issues or falling equity prices; they don’t know the example – or they know it but refuse to believe it. If Sahm’s law had been introduced without first deviating, they would probably have met the news with the same indifference. But the two dimensions together are important and meaningful. First, we get a signal that another recession is coming within 12-18 months, then we get a signal that a recession is imminent. The knocking on the door is getting louder and louder. There is something there.

However, there is disbelief. It is known that employment levels lag behind other measures during the business cycle and do not decrease until the recession begins. The fact that jobs are being added this year may comfort some people, but it probably shouldn’t. Changes in the nature of work, however, provide an important signal. Figure Three breaks down US employment between the public and private sectors. A recession tends to occur after private sector job growth slows, then falls below the rate of government job growth. This has been happening for the past half year or so – another sign of a recession.

Why would this difference in employment demonstrate the power of economic forecasting? While private employers are wealth creators and profit maximisers, public employers are resource intensive and financial exploiters. The first is the “economic” basis. If the mass production sector continues to lose positions (and jobs) to those with parasites, the real economy is also collapsing. The government is a burden on the products, not its “sustainability”.

#Decline #Yields #Predicted